Expense Records and Expense Report-Documents Needed for Employee Reimbursements

What documents are needed for employee expense reimbursements? Manage business expense records

Do you know what documents you need from employees when you reimburse them for expenses? If you’re like most small business owners, your answer is probably “No.”

You’re focused on running your business, so you aren’t thinking about reimbursing your employees. Getting the correct documents is easy when you know what to ask for.

You’ll first need to know what types of expenses qualify for reimbursement before you can understand what documents you need.

What are qualified employee expenses?

Employee expenses are costs incurred by your employees on behalf of your business. How you handle employee expenses influences your company’s bottom line.

You receive tax benefits when your employees properly track and report business expenses.

Employees’ expenses are 100% deductible by you, and your employees aren’t taxed on the reimbursement. This is known as an accountable plan.

To qualify for an accountable plan, you will reimburse your employees’ expenses when they meet all these conditions:

- The expense must have a business purpose.

- For example, you send your employee for supplies for your business. She uses her car and her money to purchase the supplies. Both the mileage and the money spent are reimbursable employee expenses.

- The expense must be documented.

- Your employee will need to provide you with an invoice or itemized receipt for the purchase. She will also need to track the round-trip mileage. The IRS standard mileage rate for 2021 is 56 cents per mile.

- Anything you pay your employee over the documented expenses must be returned.

- For example, if you mistakenly reimburse the employee for $21 instead of $12. The employee will need to return the excess $9 to you.

If you fail to meet any of the above conditions, report the expense reimbursements as wages on your employees’ W-2s. You will also have to pay your half of payroll taxes and remit them to the appropriate government jurisdictions.

How do I keep track of employee expenses?

The best way to keep track of employee expenses is to provide them with a standard expense form. A standardized form will also make it easier to process the employee reimbursement.

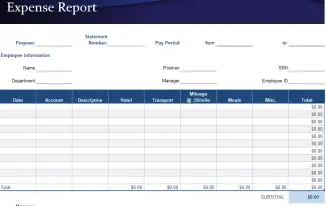

If you are a small business, the form may be as simple as one page with the following sections:

- Employee name

- Date the expense was incurred

- General ledger account number

- Expense description

- Categories (Hotel, Transport, Mileage, Meals, Miscellaneous)

- Amount

Below is a template downloaded from Microsoft Excel. It has the most common categories, as well as an approval for the manager.

Expense tracking software is available that reduces the need to store paper reports and receipts. Employees enter their expenses, upload images of the receipts, and send the final report to their manager for approval. This is an excellent option if you have remote workers.

For expense reports with high-dollar costs, consider getting upper-management approval from the CEO or CFO. They would probably want to know anyways.

What documents are necessary for expense reimbursement?

Have your employees keep careful records and always have them get a receipt. The documentation varies depending on the category but should always indicate the business purpose of the expenditure.

For hotel expenses, you will want a copy of the folio from the front desk after checking out. It should list all itemized costs during the stay, and the employee should indicate the business purpose of the visit.

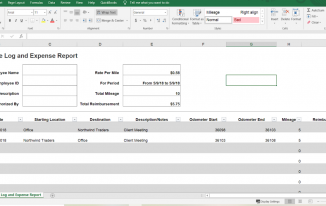

For mileage, have your employees keep track of the beginning mileage, ending mileage, and total mileage. They will need to include the drive’s business purpose and deduct any commuting miles since commuting miles are non-reimbursable expenses.

Here’s an example of what a mileage report might look like using Excel.

If your employee takes a client out for lunch, ask the employee to get both the itemized receipt, and a copy of the credit card receipt that includes the tip. Be sure the employee writes who was at lunch and what was discussed.

After the employee completes her expense report, have her put the receipts in an envelope, then staple the envelope to the expense report and give it to her manager for approval. Her manager will submit the approved report to the accounting department for payment.

The IRS recommends that you keep records for at least three years. Before shredding old documents, check with other stakeholders (such as lenders) if they have longer record-keeping requirements.

How do I pay employee reimbursements?

There are several ways to pay employees for expenses they incur on behalf of your business:

- Reimbursed on their paycheck (paid through payroll)

- Cut them a check (paid through AP)

- Pay cash (paid out of petty cash)

- Alternatives such as Paypal or Venmo (great for employees who work remotely)

For a successful expense reporting system, good records are vital. Not only for meeting your obligations under the tax code but also to keep close tabs on your business’s financial health.